How to Pilot AI at Your MSP Without Blowing Up Your Client Relationships

Here's the thing about AI pilots that nobody in the vendor world wants to acknowledge: MSPs don't get to experiment freely. You're not a SaaS startup...

Get everything you need for the ultimate client experience

Enterprise-grade infrastructure with the flexibility MSPs demand

Perfectly tailored AI that knows your specific MSP

Build your own Shopify-like store with your PSA products & distributors

Have clients to submit tickets directly to your PSA, freeing up your team's time

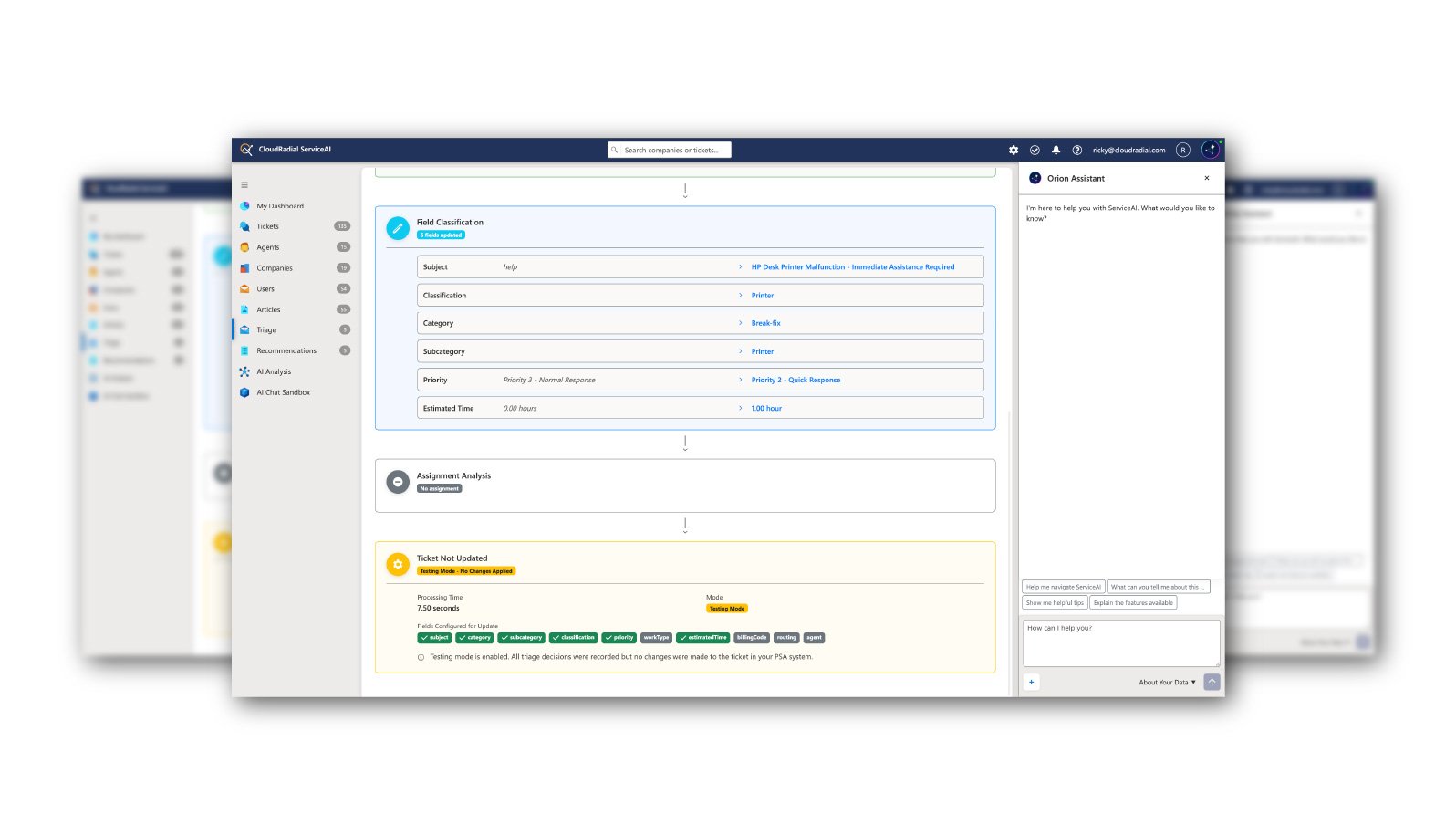

Pre-triage and route tickets correctly with the help of AI

Deliver instant, accurate answers that can help achieve zero-touch resolution

You'll learn things like how to add revenue without adding cost, MSP best practices, and how to master client management.

If every quarterly business review led to more profit and less work for both parties, everyone would make them a priority.

The goal of the QBR in a single word is “profit”. Profit for you and your clients. Profit comes from:

QBRs are not really sales calls or status reports. QBRs are opportunities to learn more about your clients and turn that understanding into projects and services clients want in return for more profit for you.

The quarterly business review (QBR) is your opportunity to understand where the client is headed so that you can get there ahead of them and deliver the solutions they’ll require. The result of the QBR is an updated plan that you and the client approve that plans for those changes. Done well, the QBR becomes very valuable to clients to help them lay out a timetable for better competitiveness and risk reduction.

A SWOT analysis (strengths, weaknesses, opportunities and threats) provides a good framework for implementing these business reviews. When working with clients, think of the review in two phases – listening and planning. In the first phase, you’ll dive deeper into client understanding to accurately assess what is and isn’t working. In the second phase, you’ll apply this understanding and your own technology insights to make sure your strategy and plans for the client are up-to-date.

The table below identifies a good starting point for your client meeting.

Strengths & Weaknesses (Listening)

Opportunities & Threats (Planning)

Over time, technologies change and offer new client opportunities. The QBR identifies those changes and helps your firm plan to accommodate those needs.

Here's the thing about AI pilots that nobody in the vendor world wants to acknowledge: MSPs don't get to experiment freely. You're not a SaaS startup...

Let's get something out of the way early: when most MSP owners hear "AI for your service desk," they picture a chatbot. Some widget sitting on a...

CloudRadial ServiceAI is purpose-built AI for MSPs, trained on your tickets, your clients, and your solutions. Get accurate support suggestions,...